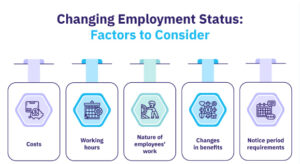

WORKER STATUS AND CHANGING TIMES – The pandemic has highlighted, but didn’t develop, an expanding variety of employee standing. There are a variety of worker kinds, from will per hour employees to excluded workers involved under work agreements and not based on base pay and overtime rules.

WORKER STATUS AND CHANGING TIMES – The pandemic has highlighted, but didn’t develop, an expanding variety of employee standing. There are a variety of worker kinds, from will per hour employees to excluded workers involved under work agreements and not based on base pay and overtime rules.

There are also a variety of various kinds of independent contractors, consisting of job employees, those that have sideline tasks, and those that work solely for a solitary company on an agreement basis ask binjaitoto.

The laws on employee category and protection are developing. The lines are obscuring in between independent contractors and workers, with more protection and greater benefits usually limited to workers being reached independent contractors.

Independent contractors are not workers, so whether a particular interaction has finished, they are not unemployed. But COVID-19 has changed this for purposes of the Pandemic Unemployment Assistance , which is the extra once a week benefits under Act and extended under the Consolidated Appropriations, 2021.

Companies pay unemployment tax obligation in behalf of their employees, self-employed people don’t pay unemployment tax obligation and cannot choose right into the system there may be some mention exemptions that I have not found. Nevertheless, self-employed people in the USA.

New York City has recently taken actions to limit at-will work standing for fast food industry employees. Under an growth to the Reasonable Workweek Legislation, employees can just be ended or have their work hrs minimized by 20% or more of their normal schedule for simply cause.

Companies must give a bona fide financial factor for shooting or lowering hrs. This increased guideline allows employees who’ve been wrongfully discharged or experienced minimized hrs beginning in 2024 to take their instance to settlement.

WHAT IS THE GLOBAL MINIMUM TAX AND DOES IT IMPACT SMALL BUSINESSES – Information headings advertise the increasing variety of countries that have consented to an around the world minimal tax obligation responsibility rate. Currently, 50 countries, which accounts for over 80% of the global financial environment, have consented to a 15% minimal tax obligation responsibility rate for companies. What is this tax obligation responsibility? Who’s based upon it? What does it indicate for small companies?

WHAT IS THE GLOBAL MINIMUM TAX AND DOES IT IMPACT SMALL BUSINESSES – Information headings advertise the increasing variety of countries that have consented to an around the world minimal tax obligation responsibility rate. Currently, 50 countries, which accounts for over 80% of the global financial environment, have consented to a 15% minimal tax obligation responsibility rate for companies. What is this tax obligation responsibility? Who’s based upon it? What does it indicate for small companies?

PURPOSE CULTURES FOR SMALL BUSINESSES – This is a great message each time when many local business are going under. The study concentrated on publicly-traded companies, but the outcomes use equally to

PURPOSE CULTURES FOR SMALL BUSINESSES – This is a great message each time when many local business are going under. The study concentrated on publicly-traded companies, but the outcomes use equally to

5 THINGS TO KNOW ABOUT BUSINESS MEAL – You gotta consume, right But when it comes to dishes, what’s

5 THINGS TO KNOW ABOUT BUSINESS MEAL – You gotta consume, right But when it comes to dishes, what’s

Develop Success And Popularity Via Book Writing – Publications stand for among the almost all rewarding items an individual can develop to position on your own as a feasible expert both in and offline, substantially.

Develop Success And Popularity Via Book Writing – Publications stand for among the almost all rewarding items an individual can develop to position on your own as a feasible expert both in and offline, substantially.

Introducing the Delights and Strategies of the Video pc gaming World – There’s definitely not a player active that would not jump at the opportunity to obtain some work as a Video game Analyzers.

Introducing the Delights and Strategies of the Video pc gaming World – There’s definitely not a player active that would not jump at the opportunity to obtain some work as a Video game Analyzers.

Moderate Video pc gaming Workstations – Numerous younger individuals will remain in determined and shocking need to have best and amazing video pc

Moderate Video pc gaming Workstations – Numerous younger individuals will remain in determined and shocking need to have best and amazing video pc

THROUGH COMPANIES: WHAT TO KNOW- Small

THROUGH COMPANIES: WHAT TO KNOW- Small

Winning Crane Video game High temperature – In the middle of the amazing lights and wayward melodies of games, a unique sensation takes hold an dependency sustained by the attraction of

Winning Crane Video game High temperature – In the middle of the amazing lights and wayward melodies of games, a unique sensation takes hold an dependency sustained by the attraction of

CREDITS TO HIRE AND RETAIN EMPLOYEES – The work opportunity tax obligation credit is a government tax obligation credit that minimizes revenue tax obligations for qualified companies. The credit is for hiring people from certain targeted teams fixed by the regulation. These teams consist of ex-felons, certain previous military workers, and lasting family assistance receivers.

CREDITS TO HIRE AND RETAIN EMPLOYEES – The work opportunity tax obligation credit is a government tax obligation credit that minimizes revenue tax obligations for qualified companies. The credit is for hiring people from certain targeted teams fixed by the regulation. These teams consist of ex-felons, certain previous military workers, and lasting family assistance receivers.